Financial Technology (FinTech): Revolutionizing Modern Financial Services

Financial Technology, commonly known as FinTech, refers to the application of technology to deliver financial services in more efficient, innovative, and customer-centric ways. Over the past decade, FinTech has fundamentally transformed how individuals and businesses manage money, make payments, access credit, invest funds, and protect financial assets. By combining finance with advanced digital tools, FinTech has reshaped traditional financial systems and created a more inclusive and agile financial ecosystem.

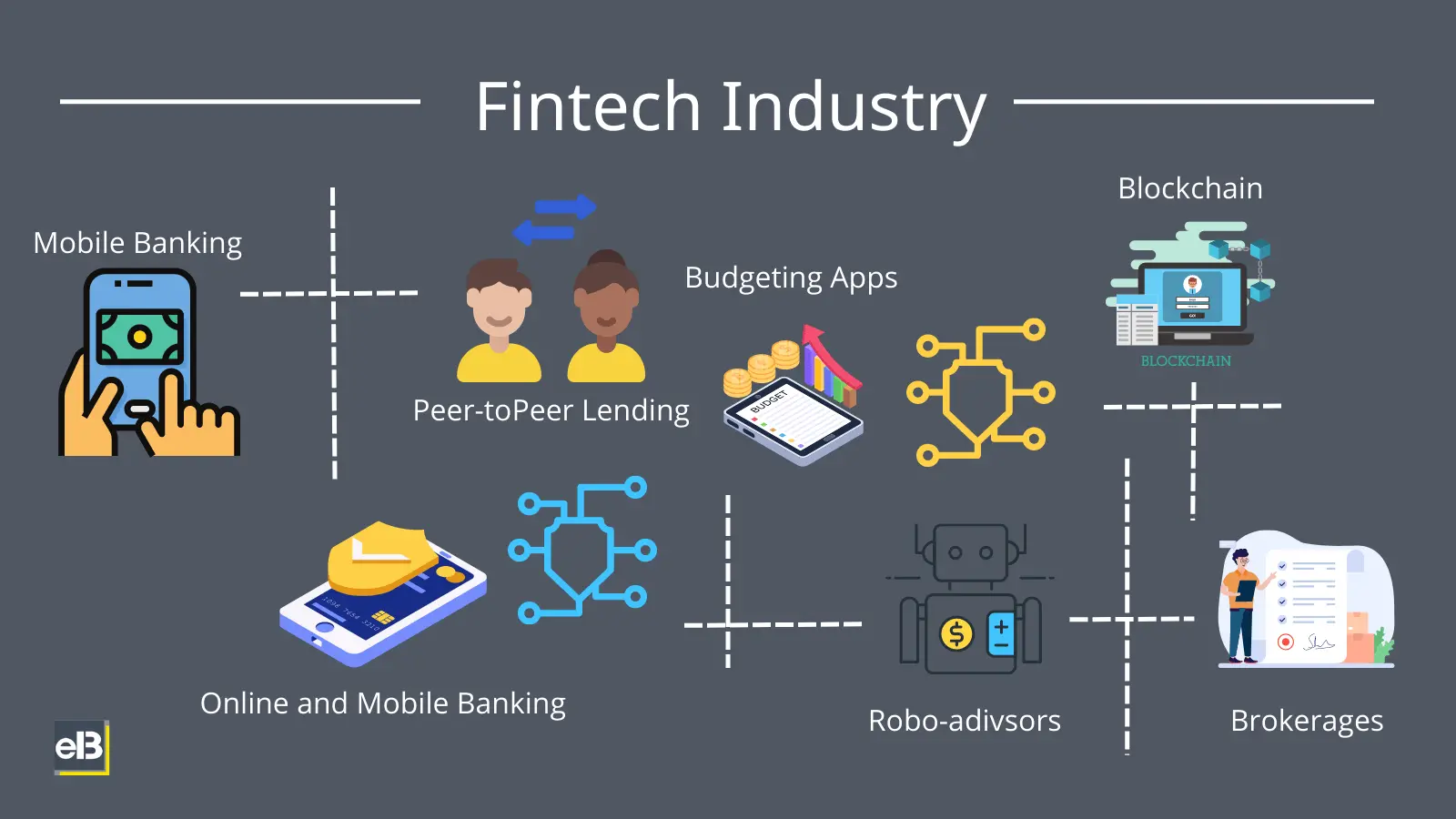

From mobile banking and digital wallets to blockchain and artificial intelligence, FinTech has become a driving force behind modernization in the global financial sector.

Meaning and Evolution of FinTech

FinTech encompasses a wide range of technological innovations designed to improve and automate financial services. While financial institutions have used technology for decades, the modern FinTech movement gained momentum with the rise of the internet, smartphones, and cloud computing.

Initially, FinTech focused on back-end operations within banks, such as record-keeping and transaction processing. Today, it directly engages consumers through user-friendly platforms that offer faster, cheaper, and more accessible financial solutions. Startups and technology-driven firms now compete with traditional banks by delivering seamless digital experiences.

Key Areas of FinTech

1. Digital Banking and Payments

Digital banking allows users to access financial services without visiting physical branches. Mobile banking apps, online accounts, and digital wallets enable instant payments, fund transfers, and bill settlements. These services have significantly reduced transaction costs and improved convenience.

Payment innovations such as contactless payments and QR-based transactions have accelerated the shift toward cashless economies, particularly in emerging markets.

2. Lending and Credit Technology

FinTech has transformed lending by simplifying loan applications and approval processes. Online lending platforms use data analytics and alternative credit scoring models to assess borrowers, making credit accessible to individuals and small businesses often overlooked by traditional banks.

Peer-to-peer lending and digital microfinance solutions have further expanded access to capital while reducing dependence on intermediaries.

3. Investment and Wealth Management

Investment-related FinTech solutions include robo-advisors, online trading platforms, and digital portfolio management tools. These platforms use algorithms to provide personalized investment advice, automate asset allocation, and rebalance portfolios at lower costs.

FinTech has democratized investing by lowering entry barriers, enabling retail investors to participate in markets with minimal capital and improved transparency.

4. Blockchain and Cryptographic Technology

Blockchain technology is one of the most disruptive elements of FinTech. It provides decentralized, transparent, and secure transaction records without relying on central authorities. Blockchain applications extend beyond digital currencies to include smart contracts, cross-border payments, and supply chain finance.

This technology enhances trust, reduces fraud, and improves transaction efficiency across financial systems.

5. Insurance Technology (InsurTech)

InsurTech applies digital innovation to the insurance industry by streamlining policy issuance, claims processing, and risk assessment. Advanced analytics, artificial intelligence, and automation enable insurers to offer customized policies, faster settlements, and improved customer experiences.

Role of Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and big data analytics are central to FinTech innovation. These technologies help analyze vast amounts of financial data to detect fraud, predict customer behavior, manage risk, and personalize services.

Machine learning algorithms continuously improve accuracy and efficiency, allowing financial institutions to make data-driven decisions while reducing operational costs.

Benefits of FinTech

FinTech offers numerous advantages for consumers, businesses, and financial institutions:

- Convenience: Anytime, anywhere access to financial services

- Cost Efficiency: Lower transaction and service costs

- Speed: Faster payments, approvals, and settlements

- Financial Inclusion: Expanded access for underserved populations

- Transparency: Clear pricing and real-time tracking

These benefits have made FinTech an essential component of modern financial systems.

Challenges and Risks in FinTech

Despite its advantages, FinTech also presents challenges:

- Cybersecurity Risks: Increased digitalization raises the risk of data breaches and fraud

- Regulatory Compliance: Rapid innovation often outpaces regulatory frameworks

- Data Privacy Concerns: Extensive data collection requires strong protection measures

- Operational Risks: System failures can disrupt services at scale

Balancing innovation with security and compliance remains a critical concern for FinTech providers and regulators.

FinTech and Financial Inclusion

One of the most significant contributions of FinTech is its role in promoting financial inclusion. By leveraging mobile technology and digital platforms, FinTech solutions reach populations lacking access to traditional banking infrastructure.

Digital payments, microloans, and mobile savings accounts empower individuals and small businesses, particularly in developing economies, to participate in formal financial systems and improve economic resilience.

Future of Financial Technology

The future of FinTech is expected to be shaped by deeper integration of artificial intelligence, expansion of decentralized finance, and greater collaboration between traditional financial institutions and technology firms. Open banking, embedded finance, and real-time payments are likely to redefine how financial services are delivered.

As innovation continues, FinTech will play a central role in building smarter, faster, and more inclusive financial ecosystems.

Financial Technology has emerged as a transformative force that is redefining the way financial services are designed, delivered, and consumed. By combining innovation with accessibility, FinTech enhances efficiency, promotes inclusion, and empowers users with greater control over their financial lives.

While challenges related to security and regulation remain, the continued evolution of FinTech promises a more connected, transparent, and resilient financial future. As technology advances, FinTech will remain at the forefront of global financial transformation.